Introducing our solutions

Designing Fit to Purpose Insurance Products for The Embedded World

Wunder Insurance creates investment neutral business cases by refunding through reduced risk, additonal revenue, and claims reduction

Embedded Insurance Solutions

Adding insurance to your business

Embedded insurance refers to the integration of insurance products within non-insurance value propositions, such as retail or services, offering customers a seamless and convenient way to purchase protection directly related to their transactions.

We also understand it as embedding (and monetising) non-insurance data and processes, like those from sensors, IoT devices, or customer insights, into insurance use cases, enhancing the personalisation and relevance of insurance offerings.

Added Value for your Customers

Insurance as cross/upsell

In addition to providing a product or service, a brand or platform can provide risk coverage (usually associated with the product or service) to a customer.

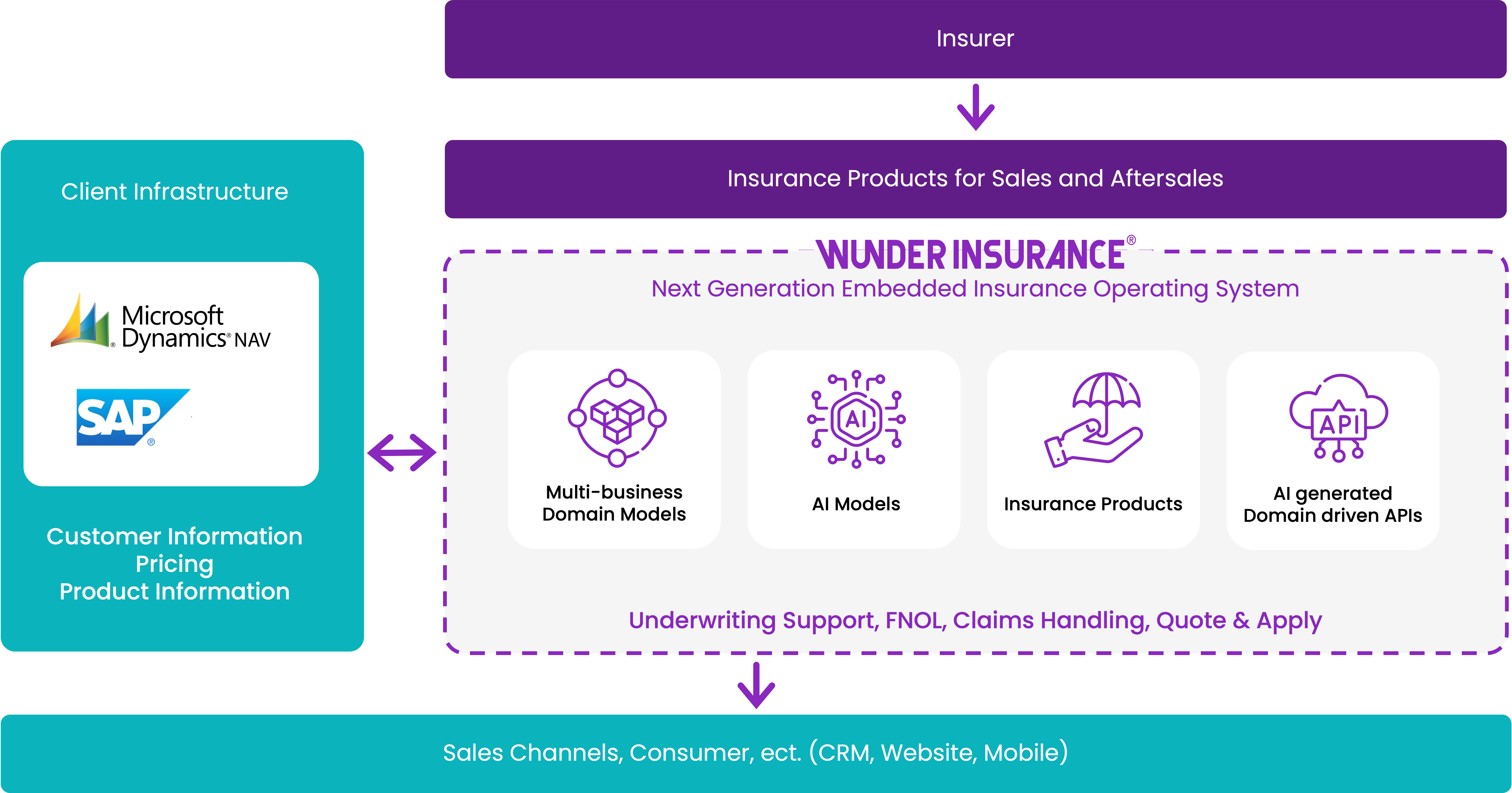

Wunder Insurance provides all necessary insurance processes and data via a generative API.

Wunder Insurance enables the insurer or reinsurer to sell standard insurance products in specific embedded insurance use cases without any additional adaptations.

Refinancing Customer acquisition costs

Insurance as substitute sell

Brands can monetize a lead that is not (yet) willing to buy a product and/or service but instead buy a risk cover (usually associated with the expected product or service transaction).

This allows to remonetize high CAC for brands while Wunder Insurance provides all necessary insurance processes and data via a generative API.

Wunder Insurance enables the insurer or reinsurer to sell standard insurance products in specific embedded insurance use cases without any additional adaptations.

Here Are Some of Our Use Cases

use case #1

Embedded Insurance Integration

- Early engagement with clients through insurance sales

- High conversion rates through early stage client binding

- After sales insurance product guarantees predictable revenue

- Insurance product sales creates additional revenue and profit

- USP over competitors

- Client protection to cover investment independent of health ínsurance

use case #2

Embedded Insurance Platform for Commercial Motor

- Integration of sensoric data to define insurance products considering lower risk and claims

- Adding additional data sources to build insurance risk scores and sell insurance products rebated on the relevant risk score

- Standard insurance products easily configurable to insurance and fleet requirements

- Optional configuration of new insurance products

- Highly integrated APIs for UI, Fullfillment, Billing, and fleet management