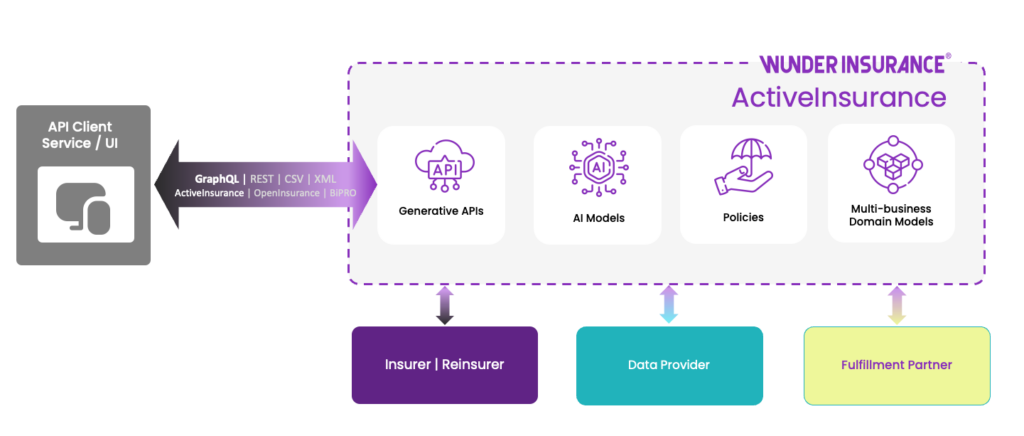

CONNECT TO THE EMBEDDED INSURANCE ECOSYSTEM

ActiveInsurance API

Active Insurance API

ActiveInsurance is the platform our partners use to integrate embedded insurance use cases in their value chains. ActiveInsurance API is a generative API around products. covers and services. Partners have easy access to all relevant insurance processes, like creating quotes and policies; manage payment plans; register and fulfil claims and more.

We constantly add more products and covers for new industries, use cases and business domains. Contact us for creating the right product for you.

Example Insurance Products API Documentation

Commercial Motor Insurance API

Secure fleet business this commercial motor insurance, offering robust protection for a vehicle fleet and financial coverage against unforeseen incidents. Keeps your vehicles and your business moving forward with confidence

Pet Insurance API

Enhances the customers’ bond with their beloved pets through a comprehensive Pet Insurance. Includes coverage of routine veterinary visits to emergency care for pet owners.

E-Bike Insurance API

Empowers customers with the confidence to ride worry-free. This E-Bike Insurance provides robust protection against theft, accidental damage, and liability.

Cyber Protection Insurance API

Shield customers’ digital assets from the ever-evolving cyber threats, empowering businesses and individuals to safeguard against data breaches, ransomware attacks, and online fraud.

How it works

ActiveInsurance API is built with GraphQL. Although we encourage you to use GraphQL to access the API, you can also make any API call via REST / HTTP.

ActiveInsurance allows for any client in addition to execute API calls to subscribe to lifecycle events of a quote, policy, payment or claim status.

Any API call is “typed”, meaning the API reflects specifically your insurance product and business domain. You can however also use the generic API (following industry standards like OpenInsurance).

You can authenticate against the ActiveInsurance API OpenID (JWT) or your own SSO system.

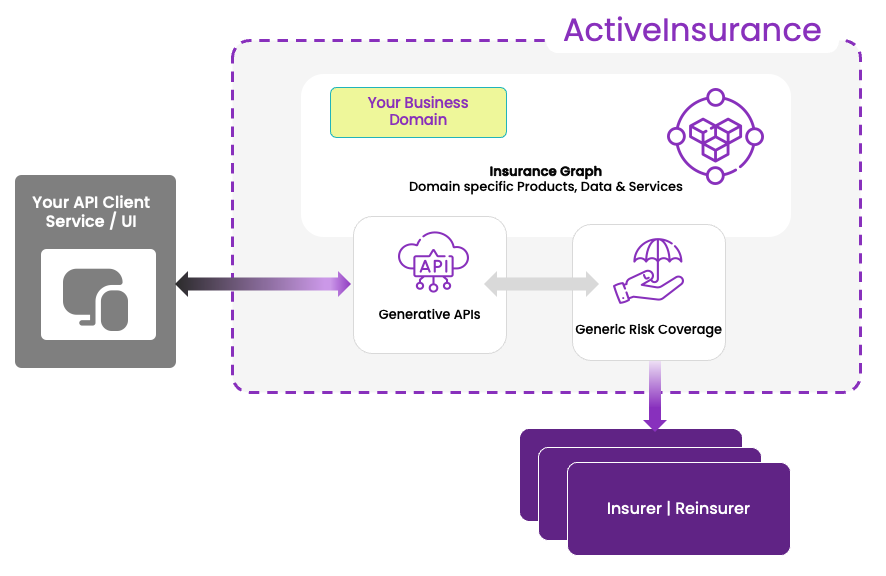

Generative API and the InsuranceGraph

Any API client accesses a dedicated environment for its insurance processes at Wunder Insurance. This environment is described in the form of an insurance graph, that is all relevant risks, covers, insurance and other data and information for the partners business domain.

While you can use any of the existing risk coverages without any additional effort, the insurance product you embed in your value chain is always according to your specific business domain. For example: if in your business every invoice address must have a mandatory “state” field in order to calculate taxes properly, the API will make sure this field exists and is correctly evaluated. In another use case this might be not be a requirement. The API will always reflect your business requirements, defaults, standard and data. And because this is achieved without any coding, we call it: generative API.

So unlike traditional, one-size-fits-all APIs, ActiveInsurance API is specifically typed for each business insurance product or process, ensuring a seamless fit into your business’s unique value chain.