Get a free embedded insurance strategy for your business

Increase sales and discover hidden revenue by offering insurance

Today’s global customers want insurance and warranties. Get more sales and improve loyalty by allowing customers to protect the things they love.

It works globally for any business. Get a free strategy on how to add embedded insurance coverage to your business now!

Why Embedded Insurance can scale your business

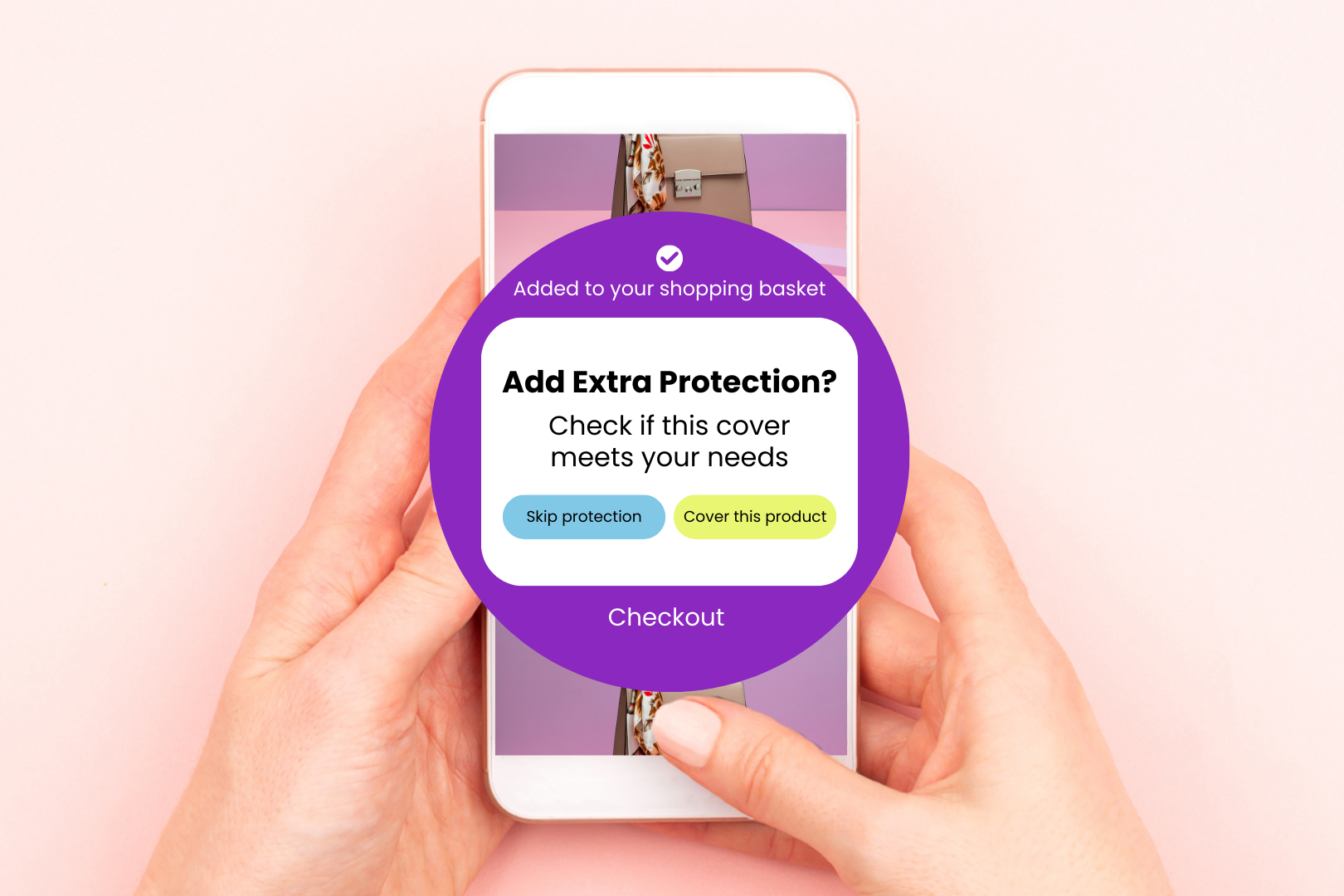

Embedded insurance is the integration of insurance coverage within the purchase process of a product or service.

It’s a strategic approach that allows businesses to offer tailored insurance solutions directly to their customers, creating a seamless experience that adds value at the point of sale.

It can also mean to embed data of an enterprise (sensor, IoT, customer insight) in an insurance value chain in order to offer a better risk coverage.

Why Embedded Insurance benefits your customers and your revenue

Missing out on the great opportunity of adding embedded insurance can prevent you from scaling your business. Embedded insurance can make you scale your business in a variety of ways:

- Enhanced customer experience: Provide your customers with relevant insurance products exactly when they need them.

- New revenue opportunities: Unlock additional income by offering insurance as a complementary product.

- Competitive advantage: Stand out in the market with innovative offerings that cater to your customers’ needs.

- Refinance your customer acqusition costs: If your customer is not yet ready to buy your product or service, you might offer him a coverage for the expected purchase, instead of letting the lead go.

- Monetise your data: Whether you are a supplier of sensors or IoT-devices, or have substantial insights to customers – this data can be valuable when used in an insurance risk analysis.